Fast. Secured. Transparent.

Islamic personal loan

loan

(beneficial)

Loan amount

Better

conditions

for repeat customers

After you've successfully repaid your first loan, you become eligible for repeat loan with the better conditions. We increase the loan amount and loan term gradually for trusted clients.

Just login to your account to get

the available conditions

available

disbursement

how

to apply

Apply online

- Choose the loan amount suitable for you on the main page

- Provide your phone number and confirm it by OTP code we send in sms.

- Submit the short application:

- - info about yourself and your job;

- - e-mail;

- - provide your bank account details;

- - attach the photos of your IC.

- Confirm your e-mail

Wait for confirmation

- We will call you in case we need to clarify the information you provided

- Get an e-mail with approved status of your application

Get money

- Follow the link we send you in e-mail or login to your account on our website to sign the contract online

- Get the money to the bank account you provided

Our service is meant for

Purposes of Islamic Personal Loan

Fund Personal Projects

Use an Islamic personal loan to fund personal projects, whether it’s home renovation, education, or other growth opportunities.

Cover Unexpected Financial Needs

Quickly cover urgent financial needs such as car repairs, rent, or other unexpected costs with an interest-free loan.

Invest in Education

Use the loan to invest in your education or skills development, with ethical financing that complies with Islamic principles.

Manage Debt Responsibly

Consolidate debts responsibly, without interest, using an Islamic loan to pay off existing liabilities.

Finance Home Improvements

Finance home improvement projects or upgrades without relying on interest-based loans, ensuring your financing is Shariah-compliant.

Support Family Expenses

Access funds to help with family obligations, such as supporting loved ones, without the burden of interest payments.

Pay for Major Life Events

Use the loan to fund weddings, anniversaries, or other significant life events, while adhering to ethical, interest-free terms.

With our loan service,

you can access quick cash for any purpose

Take the first step and apply now!

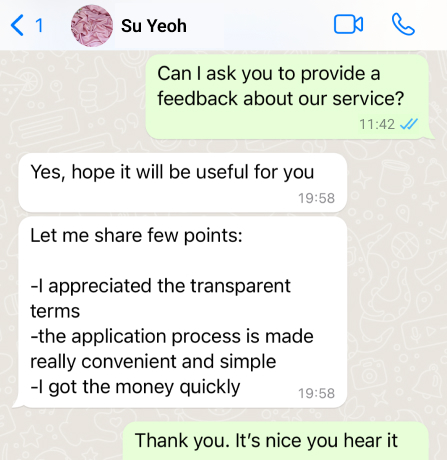

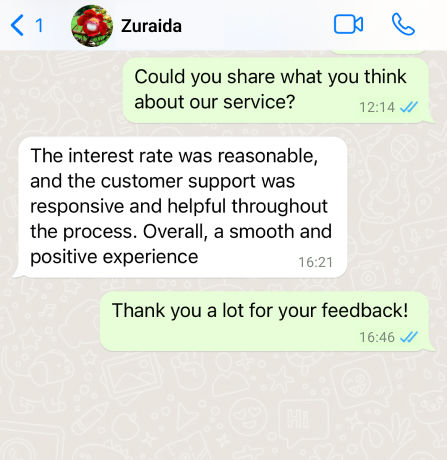

Advantages

of Islamic Personal Loan

Shariah-Compliant Financing

Enjoy financing that adheres to Islamic principles, with no interest charges, ensuring a fair and ethical loan.

Quick and Easy Application

The application process is simple and fast, with minimal paperwork required to get you approved quickly.

Apply Anytime, Anywhere

Apply for your loan anytime, from any device, with no need to visit a branch or follow office hours.

Flexible Loan Amounts

Borrow the amount that best fits your personal financial needs, whether for home improvements, personal expenses, or other projects.

Clear and Transparent Terms

All terms, including repayment plans and charges, are clearly outlined to ensure full transparency with no hidden fees.

Top-Tier Security for Your Data

Your personal information is safeguarded with the highest encryption standards, ensuring complete privacy and protection.

What is the loan term?

Minimum loan term:

92 days

Maximum loan term:

92 days for first loan and 180 days for repeat loan

The loan is

calculated as follows

The 18% interest rate is applicable to all loans consulted

Adacash do not require you to pay off the loan within 92 days.